Update: New data source

Since the launch of Price Know-how in 2013 the data for the Styenics, Polyolefins and Engineering Polymer price baskets have been sourced externally. In 2023 this approach was reviewed and following careful evaluation it has been determined that Plastribution’s own internal data source provides equivalent information with the advantages of not requiring currency conversion and of being based upon actual UK transactions.

In order to provide continuity, the internal data will be applied to all polymer pricing information contained within Price Know-how from February 2024 onwards.

We hope that you continue to value the Price Know-how publication and we always welcome any suggestions you make.

Overview

The effects on polymer supply resulting from the Houthi terrorist attacks on shipping in the Red Sea appear to have been short-lived, with converters either able to call upon their own inventories or able to purchase from local supply sources to cover the delays in shipments from Asia and the Middle East, as many shipping lines adopt the longer Cape of Good Hope route to Western Europe. However, pricing remains a contentious issue as materials shipped via the Cape of Good hope have incurred a significant cost premium which polymer suppliers are looking to pass through to customers; here producers cite limited availability as justification for significant price hikes with LDPE supply being very tight.

Polymer Production outages in Western Europe is another important factor with a series of force majeures impacting upon local polymer supply. Furthermore, US PE and PP markets continue to firm on the back of strong export demand, which may, at least in part, be a result of the Red Sea shipping delays.

The contrast between the Aromatic and Olefin feedstock cost increases is marked. The more modest C2 and C3 settlements and the late settlement of the C2 contracts likely reflects protracted negotiations resulting from the increasing delta between Naphtha/Crude Oil pricing and the weaker price of Natural Gas, which is a competing feedstock.

Any shortage of supply in Europe still appears to be transitory, as other regions of the world continue to look well supplied. This leaves polymer converters facing a dilemma on their purchasing strategies in order to cover short-term requirements whilst at the same time mitigating the risk of ending up with over-priced inventory. In this regard it does feel like the current tight market conditions may be transitory.

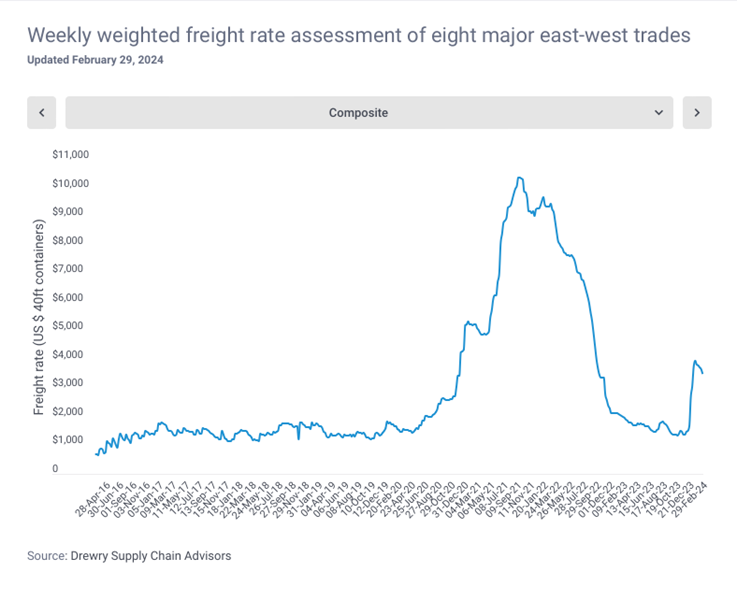

The further fall from the peak in the Drewry World Container Index for eight major east-west trades, appears to be well established and makes good sense in terms of the Red Sea situation being a smaller scale issue that the shipping challenges created by the global Covid-19 pandemic.

A number of styrenic and engineering polymer producers have started to announce increases for materials including ABS, PMMA and POM and such moves are likely to at least eliminate the lowest prices present in the market.

Monomer Price Movement

Feedstock

Price per Tonne

Change (contract)

C2 (Ethylene)

£1,047.26

£30.04

C3 (Propylene)

£944.25

£30.04

SM (Styrene Monomer)

£1,525.39

£190.57

Benzene

£1,056.70

£183.70

Brent Crude (monthly average)

£487.49

£18.06

Exchange Rates

€

1.16

$

1.27

€/$

1.09

Mike Boswell

Managing Director – Plastribution Group

Oil Prices

No Data Found

Exchange Rates

No Data Found

UK Economic Data

Topic

Item

Date

Change

Trend

GDP

Real GDP (Q on Q)

Q3 2023

£568,953

PMI

UK Manufacturing PMI

February

47.5%

UK Output

Manufacturing Index

Q4 2023

101.5%

Sales

New Car Registrations (Y on Y)

February 24

227,672

Sales

Retail Sales (Y on Y)

January 24

118.5%

Labour

Unemployment Rate

Oct – Dec 2023

3.8%

Prices

CPI (Y on Y)

January

4.0%

Prices

RPI (Y on Y)

January

4.9%

Interest Rates

Bank of England Base Rate

February

5.25%

Polyolefins

Polyolefin prices have risen strongly in February as the market saw a sudden shift in sentiment as the Red Sea shipping disruption impacted availability. Monomers saw modest increases of €5 / MT for C2 and Ethylene and €15 / MT for C3 Propylene, but these are largely irrelevant this month save for those in monomer linked contracts. All PE and PP grades saw significant increases of at least €150 / MT with some grades (LDPE) increasing by €200-250 / MT as demand significantly outstripped the immediate availability.

Buyers who had become used to readily available materials found themselves scrabbling for supply and the prices reflected this as producers and traders saw an opportunity to restore the margins lost towards the end of 2023.

These levels are likely to be relatively short lived as we are still in a global oversupply situation. Depending on who you ask, we are likely to see a return to January levels sometime between March and May as supply chains adapt and availability matches demand again.

Ian Chisnall

Product Manager – Polyolefins

Polyolefins Feedstocks

£/Metric Tonne by month

No Data Found

LDPE

Supply

Demand

LDPE has seen the biggest increases this month. Although not as affected by the Red Sea issues as other PE grades, local production / availability is not meeting demand.

LDPE production has suffered from a lack of Ethylene availability with some crackers in Europe down. A lot of European producers now have order stops in place, though material can still be obtained at a premium.

LLDPE

Supply

Demand

C4 LLDPE has generally increased by around €150 / MT depending on the starting point in January. We’re very dependent on imports from the Middle East for LLDPE and the Red Sea shipping issues are affecting these supply routes. USA imports are also more limited following the big freeze and producers seeking better returns from other regions around the world.

Other grades of LLDPE (C6 and Metallocene) are also rising by roughly €150 / MT as buyers unable to source C4 look for alternatives. Metallocene has become tighter in recent weeks as South Korean and USA imports are delayed or reduced in volume.

HDPE

Supply

Demand

HDPE has also risen by roughly €150 / MT though whilst demand is strong, this is seen as the grade with the best availability out of the PE family.

Trader stocks appear to have been boosted with some North American imports towards the end of last year. We’re still dependent on imports from the Middle East so this just could be a delayed issue that may be more acute in March.

PP

Supply

Demand

PP has also increased at least €150 / MT with many buyers reporting supply issues and delays to orders. European supply is very challenged this month with several producers either in Force Majeure or facing production issues.

We also rely on imports from the Far East for PP and these shipments are either delayed or not coming at all. This tightness on PP could persist for longer than PE with longer supply chains and more demands on the limited supply.

Other Polyolefins

EVA pricing has moved up though not as strongly as other PE grades as availability is much better with continued poor demand in European markets. Polyolefin Elastomers are a mixed picture with some stable and others following the price increases of the standard PE/PP grades.

Styrenics

Further Hikes for Contract Styrene, Polymer prices Follow.

Styrene Monomer has risen again, settling at €1777/T, an increase of €222/T from February.

For March, EU GPPS and HIPS followed, with EU ABS showing similar rises. Deep sea materials are showing an increase, albeit not as strong. Prices are expected to remain high until May at the earliest.

GPPS/HIPS/ABS supply chains are still running very low. Polymer producers have been running output at a minimum due to poor demand, and converters and distributors running inventory at very low levels due to financial pressures. Therefore, any adjustments in polymer prices are likely to be passed on immediately.

Andrew Waterfield

Product Supervisor – Styrenics

Styrenics Feedstocks

£/Metric Tonne by month

No Data Found

PS

Supply

Demand

February saw a €190/T increase in Styrene monomer, and PS rose by€150/T, with producers not passing on the full increase, possibly in an attempt to maintain demand.

March continues the upward trend, with SM rising by a further €222/T, which has been applied to PS prices. Supply and demand are both low, so remain in equilibrium. Due to this supply chains are empty, any price changes are immediate.

ABS

Supply

Demand

February ABS has saw strong rises, with EU material pushed up by the SM rise, and Deep sea grades inflated by the need to pass on extra shipping costs. (SM +€190/t, butadiene +€100, ACN +€20). Lead times were longer on far eastern materials, but there was no issue in securing volumes.

Composite Monomers are still trending upwards in March (SM +€222/t, butadiene +€75, ACN +€15). Supply and demand are still low, but availability will be improved, as far eastern materials, delayed by red sea issues, begin to arrive.

PC/ABS

Supply

Demand

As usual, PC/ABS price is following the trend of ABS.

Other Styrenics

SAN and specialities such as ASA and Q Resin continue to follow the price trend of ABS.

Engineering Polymers

Prices are starting to increase for most engineering materials as raw material costs rise, and we continue to feel the impact of vessels being redirected away from the Red Sea causing longer lead-times.

The Benzene contract for March rose by a further €214/mt to €1231/mt, which was a similar rise to February.

Sharron Jarvis

Product Supervisor – Engineering Polymers

Engineering Polymer Feedstocks

£/Metric Tonne by month

No Data Found

PA6

Supply

Demand

Producers have taken the decision to push ahead with increases in March on the back of rising raw material costs.

PA66

Supply

Demand

A similar picture to PA6, significant increases announced for March, however these could prove difficult to pass on with the current low demand.

POM

Supply

Demand

Producers are finding it difficult to try and recoup the additional shipping costs with low demand and plentiful inventories.

PC

Supply

Demand

PMMA

Supply

Demand

Price increase announcements have been made from producers for March in the region of €150-200/mt.

PBT

Supply

Demand

Weak demand and no significant changes expected.

Other Engineering Polymers

Most materials continue to be impacted by the challenges of the Red Sea situation. Prices are rising due to this and increased costs for raw materials.

Sustainable Polymers

Most recycled materials have seen increases in February on the back of some very strong increases in Prime prices. Whilst +€150 / MT is out of the question, increases of €30-80 / MT have been reported as buyers unable to secure prime stocks looked for alternatives.

Ian Chisnall

Product Manager – Sustainability

Recycled LDPE / LLDPE

Supply

Demand

Recycled LDPE / LLDPE has seen strong increases in February as Prime grades rose to levels not seen since the start of 2023. Good quality recycled material now became an option for those struggling to secure prime LDPE.

Recycled HDPE

Supply

Demand

Recycled HDPE also saw increases though perhaps not as strongly as LDPE/LLDPE. Colourable, higher-quality grades suitable for blow moulding of personal care packaging saw stronger increases compared to black grades.

.

Recycled PP

Supply

Demand

Recycled PP rose by around €50 / MT as buyers looked for alternatives to either increasingly expensive or simply not available prime grades. Colourable grades were perhaps above this with black compounds possibly a bit below.