Join us at the Festival of Polymer Innovation

The team behind Price Know-How will be at the Festival of Polymer Innovation on 4th September 2024.

Overview

Are markets about to tighten, as the economics of imports from other regions look increasingly unfavourable?

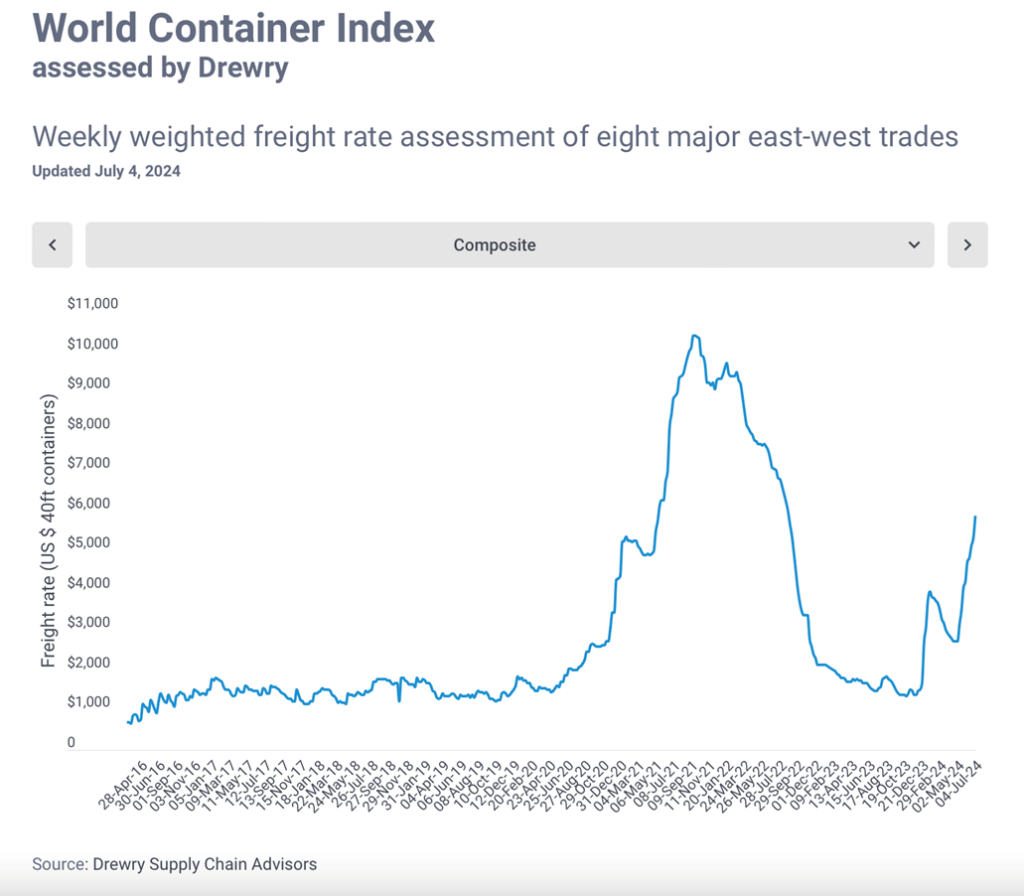

It is pretty much the case of the same story; different month as the inflationary price pressures described in the June edition of Price Know-how continue to build. However, the sense of ambivalence coming from converters is starting to diminish and a recent flurry in attempts to secure additional volumes at June price levels is giving sellers increasing confidence that prices are about to move forward. As expected, some converters point to slack demand in Western Europe, as the summer holiday season gets underway, putting sellers under pressure as demand typically falls away. Others are taking the view that what has been a sustained increase in shipping costs due to issues including vessel capacity, container availability, port congestion and higher costs still resulting from diverting shipping routes around the Cape of Good Hope to avoid the issues affecting the Red Sea, as being likely to diminish as China starts to throttle back its exports.

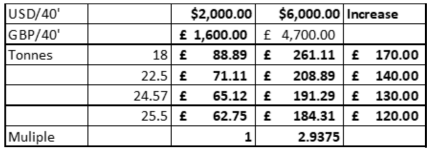

Taking the most recent publication of Drewry World Container Index weekly weighted freight rate assessment of eight major east-west trades, the overall jump of some $4,000 per 40’ container, since the start of the year, equates to the following table of cost increases per tonne based upon current exchange rates:

Even taking the best case of loading 25.5 tonnes into a 40’ shipping container, the £120 increase in shipping cost per tonne will be prohibitive for standard polymers, and the majority of engineering polymers that originate from the Far-East.

Polymer production in many regions of the world is now a lossmaking activity, often not even covering variable costs, and hence more and more producers are taking the decision to idle production. Reducing output will restrict availability and this will help to rebalance supply and demand.

It is going to be interesting to observe price action over the summer months, and converters with limited inventory are most likely to experience price increases.

Monomer Price Movement

Feedstock

Price per Tonne

Change (contract)

C2 (Ethylene)

£1,032.99

£0.00

C3 (Propylene)

£935.62

£0.00

SM (Styrene Monomer)

£1,305.63

-£116.85

Benzene

£838.25

-£137.17

Brent Crude (monthly average)

£489.80

-£5.31

Exchange Rates

€

1.18

$

1.27

€/$

1.08

Mike Boswell

Managing Director – Plastribution Group

Oil Prices

No Data Found

Exchange Rates

No Data Found

UK Economic Data

Topic

Item

Date

Change

Trend

GDP

Real GDP (Q on Q)

Q1 2024

£570694

PMI

UK Manufacturing PMI

June

50.9%

UK Output

Manufacturing Index

Q1 2024

102.7%

Sales

New Car Registrations (Y on Y)

May YTD

827,500

Sales

Retail Sales (Y on Y)

May 24

118.9%

Labour

Unemployment Rate

Feb 24 – Apr 24

4.4%

Prices

CPI (Y on Y)

May

2.0%

Prices

RPI (Y on Y)

May

3.0%

Interest Rates

Bank of England Base Rate

June

5.25%

Polyolefins

Although both monomers Ethylene C2 and Propylene C3 rolled over, Polyolefin prices are starting to rise in July on the back of restricted availability. The global shipping issues are worsening with port congestion and rising freight rates as ships avoid the Suez Canal. Containers from Southeast Asia to Europe are now hitting $10,000 adding £200-300 / MT to the delivered cost of polymer. European production is being kept at low run rates to try and balance supply and demand. Some plants are still in Force Majeure with technical upsets and industrial action.

Some producers are already implementing order stops and more are predicted with further increases in August expected. Whilst demand remains muted buyers are likely to have to pay the higher prices to secure the limited supplies. Hurricane Beryl is impacting production of most PE and PP grades and is likely to limit exports from the USA to Europe.

Ian Chisnall

Product Manager – Polyolefins

Polyolefins Feedstocks

£/Metric Tonne by month

No Data Found

LDPE

Supply

Demand

LDPE is increasing by approx. €20-50 / MT depending on the starting point and the stock position of the individual supplier. Force Majeures are in place in Europe on LDPE and supply is limited.

LLDPE

Supply

Demand

C4 LLDPE is increasing €30-50 / MT as imports dry up and availability becomes scarcer. Some large converters bought ahead in June further limiting immediate availability. Middle East supplies are facing logistics disruption and USA producers are increasing prices and limiting exports due to stronger local demand and some stock building to mitigate potential impacts of Hurricanes.

HDPE

Supply

Demand

HDPE is similar to LLPDE with limited imports available and some small signs of improving demand, particularly on Blow Moulding grades. Prices are typically increasing €20-40 / MT with a widening gap from Injection to Blow Moulding.

PP

Supply

Demand

Other Polyolefins

EVA pricing has mostly rolled over following heavy discounts given in recent months to stimulate demand. Polyolefin Elastomers and Plastomers are rolling over.

Styrenics

Contract EU Styrene slumps, EU polymer prices follow, but Far East imports rise with shipping increases.

Styrene Monomer has suffered a steep drop, settling at €1542/T, a decrease of €138/T from June.

For July, EU GPPS, HIPS and ABS has fallen. Deep sea materials have increased due to rising shipping costs, and all FR materials are increasing due to steep rises in Antimony Trioxide notations, attributed to increased demand in China for Solar Panel production.

GPPS/HIPS/ABS supply chains are still running very low. Polymer producers have been running output at a minimum due to poor demand, and converters and distributors running inventory at very low levels due to financial pressures. Therefore, any adjustments in polymer prices are likely to be passed on immediately.

Andrew Waterfield

Product Supervisor – Styrenics

Styrenics Feedstocks

£/Metric Tonne by month

No Data Found

PS

Supply

Demand

June saw a €30/T decrease in Styrene monomer, and PS followed, although some producers muted their response with reductions of only €5-10/T

July brings a much steeper drop, with SM falling by €138/T, and PS producers seem to be following in full. Supply and demand are both low, so remain in equilibrium. Due to this supply chains are empty; any price changes could be immediate.

ABS

Supply

Demand

June prices stabilised (SM -€30/t, butadiene +€25, ACN -€40), but demand remained stagnant as converters waited for the bottom of the market. Shipping cost from the far east were rumoured to be on the rise, possibly back to 2020 levels. Any increase was being absorbed, but there was an expectation that this could drive prices upwards in the coming weeks.

July delivered a big drop for EU grades (SM -€138/t, butadiene hold, ACN -€3/T), and as predicted due to the Suez issues, Far East producers loaded quotes with increased shipping charges, a minimum of $75/T. Huge demand for FR additives has created a shortage, and flame retardant polymers are seeing a further $100/T increase.

PC/ABS

Supply

Demand

As usual, PC/ABS price is following the trend of ABS.

Other Styrenics

SAN and specialities such as ASA and Q Resin continue to follow the price trend of ABS.

Engineering Polymers

Demand remains relatively weak and supply is more than adequate for most engineering materials. The July benzene contract settled €162/mt lower at €990/mt, which means that most prices will come under further downwards pressure going into the new quarter and the traditional holiday period. The only exception is PMMA, where the ongoing shortage of MMA means that prices will increase.

Sharron Jarvis

Product Supervisor – Engineering Polymers

Engineering Polymer Feedstocks

£/Metric Tonne by month

No Data Found

PA6

Supply

Demand

Demand remains low, and with the reduction in the benzene price and the upcoming summer holidays, most producers have had to settle for rollover at best.

PA66

Supply

Demand

PA66 is under even more downwards price pressure than PA6 due to the triple digit reduction in benzene cost. Demand also remains very weak going into the holiday season, so there are likely to be some cost reductions and cheap prices in the market.

POM

Supply

Demand

Demand is weak and there will be more downward pressure on prices. The most likely outcome for POM in July will be rollover or a slight reduction, despite the ongoing container/freight issues.

PC

Supply

Demand

PMMA

Supply

Demand

It is expected that PMMA prices will rise again in July due to ongoing MMA supply restrictions. Whilst demand remains on the low side, producers are standing firm and insisting on cost increases.

PBT

Supply

Demand

Poor demand and lack of appetite for any changes for PBT in July mean that prices will probably rollover at best, or even face a small reduction as the holiday season approaches.

Other Engineering Polymers

The current situation for most other engineering materials is similar, due to weak demand, lower feedstock costs and the start of the holiday period.

Sustainable Polymers

Recycled materials have seen slight increases in July. Some converters are turning to recycled as prime grades are increasing in price and availability is limited. We also see some signs of increased demand from brands for more Sustainable options pushing up prices for the higher quality materials suitable for packaging of FMCGs.

Ian Chisnall

Product Manager – Sustainability

Recycled LDPE / LLDPE

Supply

Demand

Recycled LDPE / LLDPE has increased in July with some recyclers pushing through €50 / MT as they have very limited availability and stronger demand.

Recycled HDPE

Supply

Demand

Recycled HDPE is also seeing stronger demand, particularly in the higher quality grades for consumer packaging. Natural blow moulding grades continue to command a very significant premium over prime. Lower quality grades are also doing OK with signs of increased demand in non-critical construction applications.

Recycled PP

Supply

Demand

Recycled HDPE is also seeing stronger demand, particularly in the higher quality grades for consumer packaging. Natural blow moulding grades continue to command a very significant premium over prime. Lower quality grades are also doing OK with signs of increased demand in non-critical construction applications.