Join us at the Festival of Polymer Innovation

The team behind Price Know-How will be at the Festival of Polymer Innovation on 4th September 2024.

Overview

Prices edge forwards in August, with further increases likely to be implemented as September approaches.

In July it was already evident that ‘special deals’ on PE and PP standard grades were no longer available, and the £16.93 (€20) per tonne increase applied to the August contract price for C2 and C3 went on to send a clear signal to the market that prices are back on the way up. In some cases, producers have outlined ‘triple digit’ increases, particularly for LDPE, although the timing of these adjustments is a little vague, and September may be the backstop for implementation. In any event, buyers at polymer converters are looking for opportunities to secure inventories at attractive prices, although many remain sceptical about the durability of any increases and are of the expectation that prices will moderate in the final quarter of 2024.

On a separate note, the styrenic polymer value chain provided a classic response to changes in availability. In this instance a SM (Styrene Monomer) outage at the Shell Moerdijk plant in the Netherlands caused a price spike as polystyrene producers became concerned about feedstock availability.

Geopolitical tensions in the Middle East, are also a topic of speculation and as with the polymer market, crude oil price action continues to bounce between the risk of a larger scale conflict causing supply shortages, and weak consumer demand. Any escalation of conflict in the Middle East region would likely push crude oil and polymer pricing in a clear upward direction.

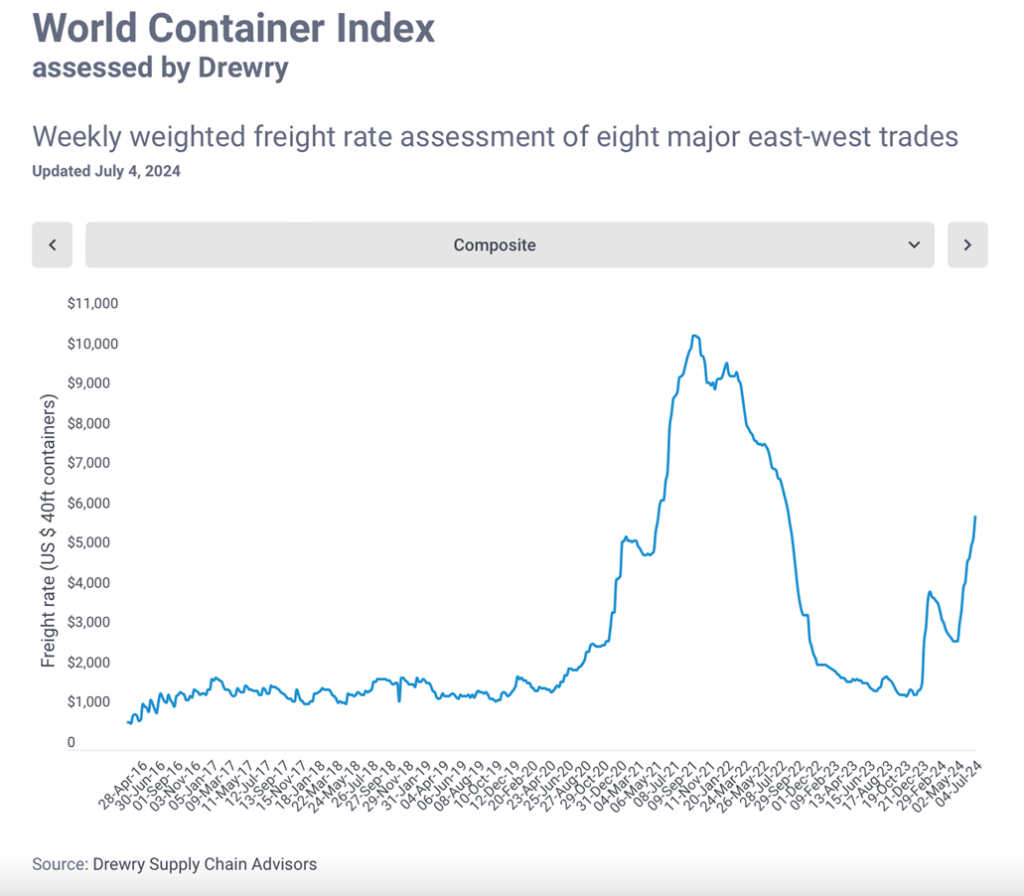

In the interim, high shipping costs continue to influence imports of ABS and engineering polymers from Asia.

With just a couple of weeks until the summer season ends, the September price action will soon become evident.

Monomer Price Movement

Feedstock

Price per Tonne

Change (contract)

C2 (Ethylene)

£1,049.93

£16.93

C3 (Propylene)

£952.55

£16.93

SM (Styrene Monomer)

£1,371.68

£66.04

Benzene

£838.25

-£71.12

Brent Crude (monthly average)

£492.00

-£5.31

Exchange Rates

€

1.18

$

1.27

€/$

1.08

Mike Boswell

Managing Director – Plastribution Group

Oil Prices

No Data Found

Exchange Rates

No Data Found

UK Economic Data

Topic

Item

Date

Change

Trend

GDP

Real GDP (Q on Q)

Q1 2024

£570694

PMI

UK Manufacturing PMI

July

52.1%

UK Output

Manufacturing Index

Q1 2024

102.7%

Sales

New Car Registrations (Y on Y)

June YTD

1,006,763

Sales

Retail Sales (Y on Y)

June 24

117.7%

Labour

Unemployment Rate

Mar 24 – May 24

4.4%

Prices

CPI (Y on Y)

June

2.0%

Prices

RPI (Y on Y)

June

2.9%

Interest Rates

Bank of England Base Rate

August

5.0%

Polyolefins

With both monomers Ethylene C2 and Propylene C3 increasing by €20 / MT, Polyolefin prices are continuing to climb in August. Most grades are achieving increases above the monomer with some seeing restricted availability and slightly better demand.

European Production is being scaled back to match supply with the muted demand and imports continue to be limited. Imports are lower because of high freight rates (though these are starting to ease) and better returns in other parts of the world.

Ian Chisnall

Product Manager – Polyolefins

Polyolefins Feedstocks

£/Metric Tonne by month

No Data Found

LDPE

Supply

Demand

LDPE is increasing by approx. €50 / MT as it appears to be the grade with the most restricted availability. Some producers went into order stop for LDPE very early in the month and supply appears to be tighter. Outlook for September appears to be for relative stability though supply pressures may help push prices up further.

LLDPE

Supply

Demand

C4 LLDPE is increasing €30-50 / MT depending on the starting point and the availability with individual suppliers. Increases above monomer are possible as supply continues to be limited with reduced imports from Middle East and USA. US Producers are citing strong local demand and pushing price increases through. Longer term outlook will partly depend on how bad the Hurricane Season is and the possible effects on petrochemical production in the Gulf Coast area. We could see better availability towards the end of the year. Metallocene prices also rose with some pockets of tightness with reduced imports from key areas South Korea and USA.

HDPE

Supply

Demand

HDPE appears to have more balance in supply and demand and increases are more moderate in the region of €20-30 / MT. HDPE, like LLDPE is affected by a lack of imports but demand appears slightly more muted, and increases have been moderated. Outlook is similar to LLDPE and will be heavily influenced by how strong imports are over the coming months.

PP

Supply

Demand

PP pricing has increased in August by around €40-50 / MT. Impact Copolymer grades are seen as quite tight in availability as we partly rely on imports for these, and we continue to see restricted production in Europe. There are several European Force Majeures in place at the time of writing. Homopolymer pricing is also up more than some expected as demand is relatively good in key sectors such as packaging.

Other Polyolefins

EVA pricing has risen €30 / MT, roughly in line with monomer. Polyolefin Elastomers are typically increasing by €20 / MT in line with the monomer increase.

Styrenics

Contract EU Styrene rises, EU polymer prices follow.

Styrene Monomer has risen by €78T, settling at €1620/T, due to shortages in EU production.

For August, EU GPPS, HIPS and ABS has risen. Deep sea materials have increased due to rising shipping costs, and all FR materials are increasing due to steep rises in Antimony Trioxide notations, attributed to increased demand in China for Solar Panel production.

GPPS/HIPS/ABS supply chains are still running very low. Polymer producers have been running output at a minimum due to poor demand, and converters and distributors running inventory at very low levels due to financial pressures. Therefore, any adjustments in polymer prices are likely to be passed on immediately.

Andrew Waterfield

Product Supervisor – Styrenics

Styrenics Feedstocks

£/Metric Tonne by month

No Data Found

PS

Supply

Demand

July saw a €138/T decrease in Styrene monomer, and PS followed down.

August brings a reversal due to SM shortages, with monomer rising by €78/T. PS producers are treating this as a minimum increase. Supply and demand are both low, so remain in equilibrium. Due to this supply chains are empty; any price changes could be immediate.

ABS

Supply

Demand

July delivered a big drop for EU grades (SM -€138/t, butadiene hold, ACN -€3/T), and as predicted due to the Suez issues, Far Eastern producers loaded quotes with increased shipping charges, a minimum of $75/T. Huge demand for FR additives created a shortage, and flame retardant polymers saw a further $100/T increase.

Expect further rises in August (SM +€78/t, butadiene +€25/t, ACN +€36/t). Deep Sea imports will become more attractive. Demand and supply are both low

PC/ABS

Supply

Demand

As usual, PC/ABS price is following the trend of ABS.

Other Styrenics

SAN and specialities such as ASA and Q Resin continue to follow the price trend of ABS.

Engineering Polymers

The situation remains broadly the same in August as it was for July, i.e. fairly quiet during this traditional holiday season for many in the UK and parts of Europe. Weak demand and sufficient supply are the current comments for most engineering materials. The August benzene contract settled €84/Mt lower at €906/Mt, however, Polycarbonate has seen an increase from Asia due to rising sea freight costs. Producers of PMMA forged ahead with three digit increases due to the ongoing shortage of MMA.

Sharron Jarvis

Product Supervisor – Engineering Polymers

Engineering Polymer Feedstocks

£/Metric Tonne by month

No Data Found

PA6

Supply

Demand

Minor change from July, lower demand, and with the reduction in the benzene price and the summer holidays, most producers have had to settle for rollover at best.

PA66

Supply

Demand

Demand also remains very weak for PA66 going into the holiday season, so there are likely to be some cost reductions and cheap prices in the market.

POM

Supply

Demand

Demand is weak, producers are settling at rollover pricing for August, despite the rising cost of sea freight.

PC

Supply

Demand

PMMA

Supply

Demand

As expected PMMA prices did rise in July due to ongoing MMA supply restrictions. Whilst demand remains on the low side, producers are standing firm and insisting on cost increases.

PBT

Supply

Demand

Little in the way of change for August. Poor demand and lack of appetite for any changes mean that prices will rollover.

Other Engineering Polymers

The current situation for most other engineering materials is similar, due to weak demand, lower feedstock costs and the start of the holiday period.

Sustainable Polymers

Recycled materials have seen rollover to slight increases in August depending on the quality and availability of product. With virgin prices climbing, demand for recycled grades has strengthened and some recyclers have increased their offers accordingly. Demand for consistent quality natural grades continues to grow as brands push their “Green” credentials.

Ian Chisnall

Product Manager – Sustainability

Recycled LDPE / LLDPE

Supply

Demand

Recycled LDPE / LLDPE has increased slightly in August, but some have conceded rollover as although demand is slightly better, there is still spare capacity in the industry, particularly on the less popular, lower quality grades.

Recycled HDPE

Supply

Demand

Recycled HDPE is around rollover with virgin prices for HDPE not increasing as much as other PE grades. We continue to see strong demand for natural grades, particularly in consumer packaging such as toiletries. These grades continue to command a significant premium over virgin.

Recycled PP

Supply

Demand

Recycled PP is also around rollover as although virgin PP has increases around €30-50 / MT in August, we still see very good availability of recycled PP, especially in the black and wide specification grades. Some small increases have been reported but are typically in the higher specification grades.