Overview

The market sentiment in November was bleak, with demand from converters remaining weak and sellers competing vigorously for any available sales. For many polymer producers the impeding low demand in the December period as converters take seasonal holidays creates further pressure, as the need to move product through the supply chain in order to create storage capacity becomes a priority. In the case of US origin materials, many states impose a year-end inventory tax, which creates an incentive to push material into export markets. Most UK converters appear to be adopting a ‘wait and see’ strategy with regard to Q1 2024 purchasing, on the basis that market fundamentals remain weak and supply bountiful.

Players are still confused by the lack of demand from converters with questions about substitution, supply chain destocking, fundamental shifts in consumer behaviour, and increased polymer production remaining unanswered.

The situation for engineering polymers remains largely unchanged, with suppliers also seeking to win market share through price competition.

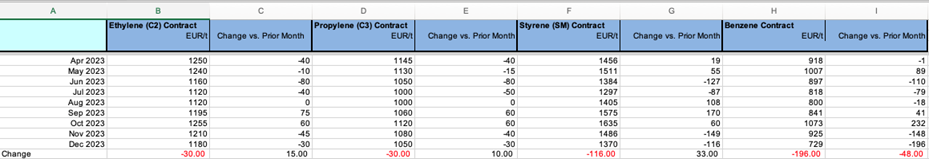

Click the table above to zoom in.

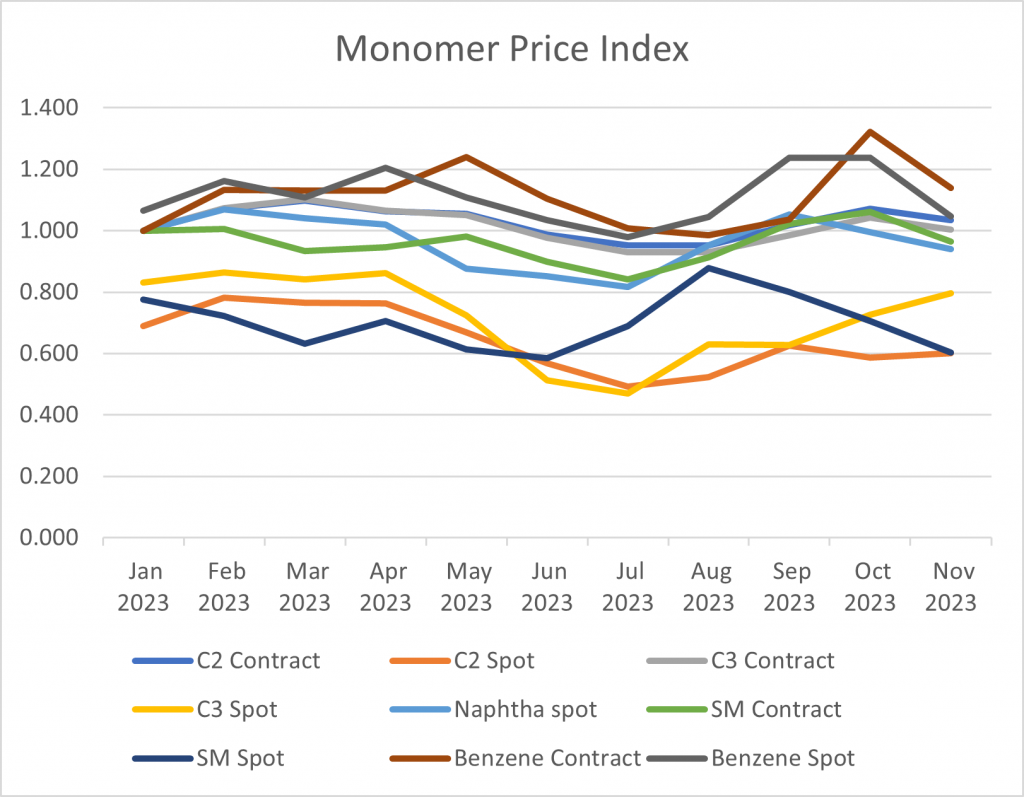

Monomer Price Movement

Feedstock

Change (Contract)

C2 (Ethylene)

-£26.11

C3 (Propylene)

-£26.11

SM (Styrene Monomer)

-£100.96

Benzene

-£170.59

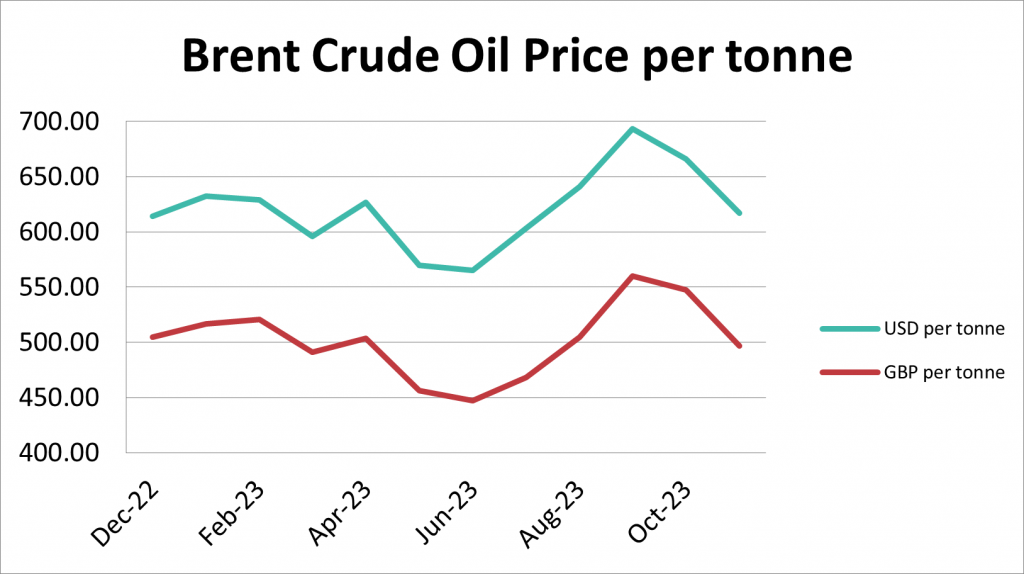

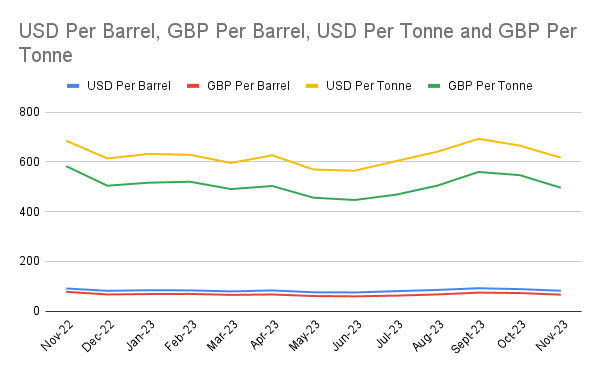

Brent Crude (monthly average)

-£50.77

Exchange Rate

1.15

Mike Boswell

Managing Director – Plastribution Group

Oil Prices

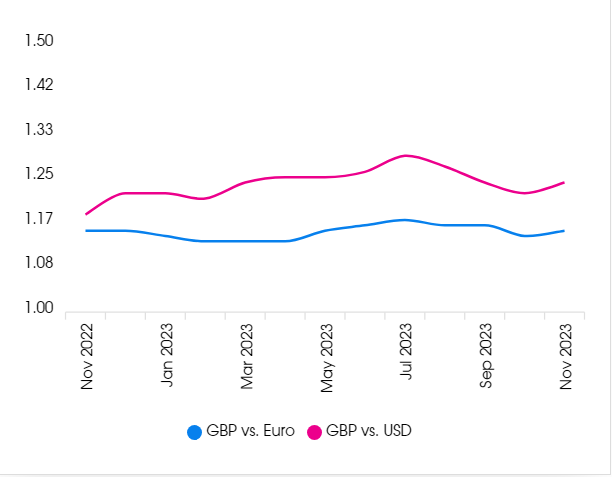

Exchange Rates

UK Economic Data

Topic

Item

Date

Change

Trend

GDP

Real GDP (Q on Q)

Q2 2023

£571,043

PMI

UK Manufacturing PMI

November

47.2%

UK Output

Manufacturing Index

Q3 2023

102.2%

Sales

New Car Registrations (Y on Y)

October 23

156,525

Sales

Retail Sales (Y on Y)

October 23

116.9%

Labour

Unemployment Rate

May – July 2023

4.3%

Prices

CPI (Y on Y)

October

4.6%

Prices

RPI (Y on Y)

October

6.1%

Interest Rates

Bank of England Base Rate

November

5.25%

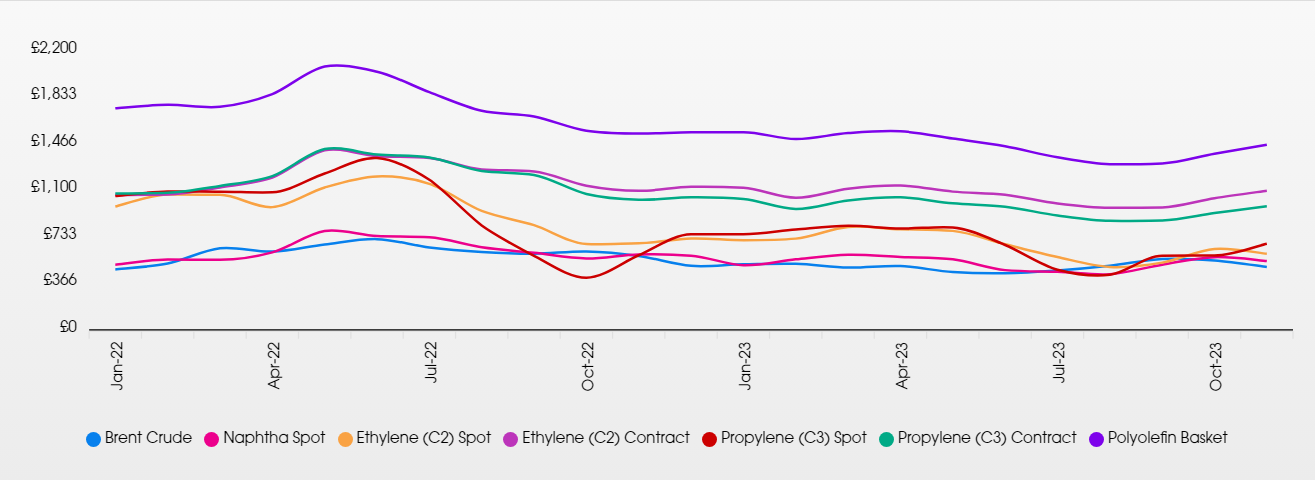

Polyolefins

Polyolefin prices continued to fall on the back of the monomer drops of €30 / MT for both ethylene C2 and propylene C3.

As in November, there were attempts to limit the reductions in line with monomer, but this has only really held on LDPE. This is showing a few signs of being in a more balanced position with major producers in Europe announcing order stops before the middle of the month.

Other Polyolefins fell by around €50-80 / MT depending on the grade, the starting point in November and the desire of the seller to move stocks in a very quiet market. Market conditions remain very quiet with little demand from consumers and some converters are planning on closing early for Christmas as there is so little demand for product.

As ever, supply and demand remain the key drivers for polymer pricing and there are many rumours about producers slowing or even stopping plants altogether to limit availability and restore some balance. But with imports benefiting from lower cost bases, there seems to be no sign that this will be done on a global level so it could just mean that Europe becomes more reliant on imports and prices stay relatively flat. PE and PP are both in a global oversupply situation and we are many months away from demand catching up with the new capacity that has been built.

Ian Chisnall

Product Manager – Polyolefins

Polyolefins Feedstocks

£/Metric Tonne by month

LDPE

Supply

Demand

LDPE has fallen roughly in line with monomer in December. One of the few grades that appears to be a little bit tight. European producers are reducing run rates as plants are not profitable.

Major producers have announced order stops for the rest of December. Some have reverse the €30 reduction and are now asking for the same price they had in November. LDPE could be one of the few materials that sees a reversal in pricing in January.

LLDPE

Supply

Demand

C4 LLDPE has fallen around €50-80 / MT depending on the supplier and the November starting point. Lower prices are being quoted but, in many instances, these are for import grades that are not yet on the way and will not arrive until late January / February.

There is a global excess of LLDPE and it is expected that prices will stay quite flat for the foreseeable future even with the negative margins for producers in some regions. LLDPE C6 continues to have only a small premium over C4 due to excess availability. Generic Metallocene grades are also very widely available and prices reflect this.

HDPE

Supply

Demand

HDPE has dropped between €30-60 / MT depending on the supplier and the grade. Film grades appear to be a little bit tighter with Blow moulding the most widely available. Injection grades sit somewhere in the middle.

Imports appear to be strong, and we can expect arrivals from USA and the Middle East to be plentiful in early 2024 keeping prices under pressure. Outlook for January appears to be relatively flat both in demand and pricing.

PP

Supply

Demand

PP has dropped €30-60 / MT depending on the grade. Some suggestions that Co-polymer grades are a little tighter, especially for low MFI grades in extruded profile applications. Homopolymer is widely available but not always in the most desirable specification.

As with PE, imports from all around the world are expected to arrive in early 2024 with global demand poor and new capacities coming on stream. Prices are expected to stay flat in line with poor demand.

Other Polyolefins

EVA pricing has moved down around €100 / MT as producers look to move stock in a quiet market. Polyolefin Elastomers appears to be stable as they are typically priced quarterly.

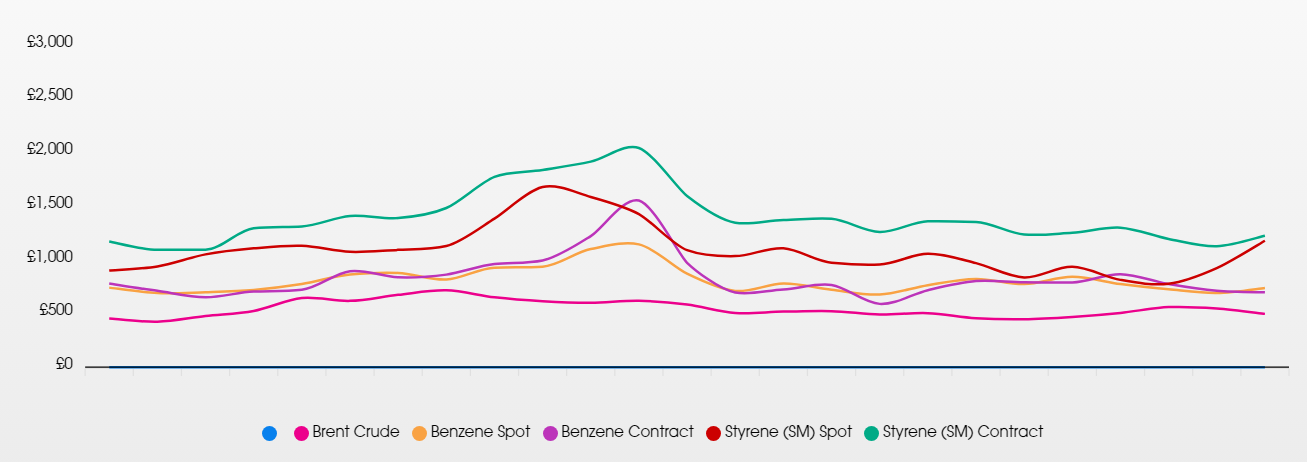

Styrenics

Contract Styrene Monomer Continues to Fall

Styrene Monomer has dropped for two months in a row, settling at €1370/T, a decrease of €116/T from November. The main driver was poor demand, and even a supply outage at an EU producer did nothing to reverse this.

For December, EU GPPS and HIPS has decreased by €140T, and EU ABS will decrease also.

GPPS/HIPS/ABS supply chains are running very low. Polymer producers have been running output at a minimum due to poor demand, and converters and distributors running inventory at very low levels due to financial pressures. Therefore, the adjustments in polymer prices is likely to be passed on immediately.

It is to be noted that the shift in EU styrene monomer is unlikely to have a large effect on Styrenic materials imported from the Far East, where prices have remained flat for the last few months.

Andrew Waterfield

Product Supervisor – Styrenics

Styrenics Feedstocks

£/Metric Tonne by month

PS

Supply

Demand

SM supply limitations faded in November, and monomer drops (-€149/T) pulled prices down, with GPPS and HIPS falling by €140/T. Supply was throttled as producers ran at a minimum, but this had little effect on availability as demand slumped too.

December delivers further falls with SM sliding downwards by €116/T, causing a drop of around €140/T for GPPS and HIPS. Supply remains low, and the Christmas holidays are compressing already weak demand to very low levels. Supply is not a problem!

ABS

Supply

Demand

November ABS fell, driven by composite monomer drops (SM -€149/t, butadiene +€ 15/t, ACN +€27/t).

No change in this trend is expected in December (SM -€116/t, butadiene -€ 10/t, ACN -€28/t). Deep-sea material is more stable, but supply is still outstripping demand. As with PS, demand is expected to be very low.

PC/ABS

Supply

Demand

As usual, PC/ABS price is following the trend of ABS.

Other Styrenics

SAN and specialities such as ASA and Q Resin continue to follow the price trend of ABS.

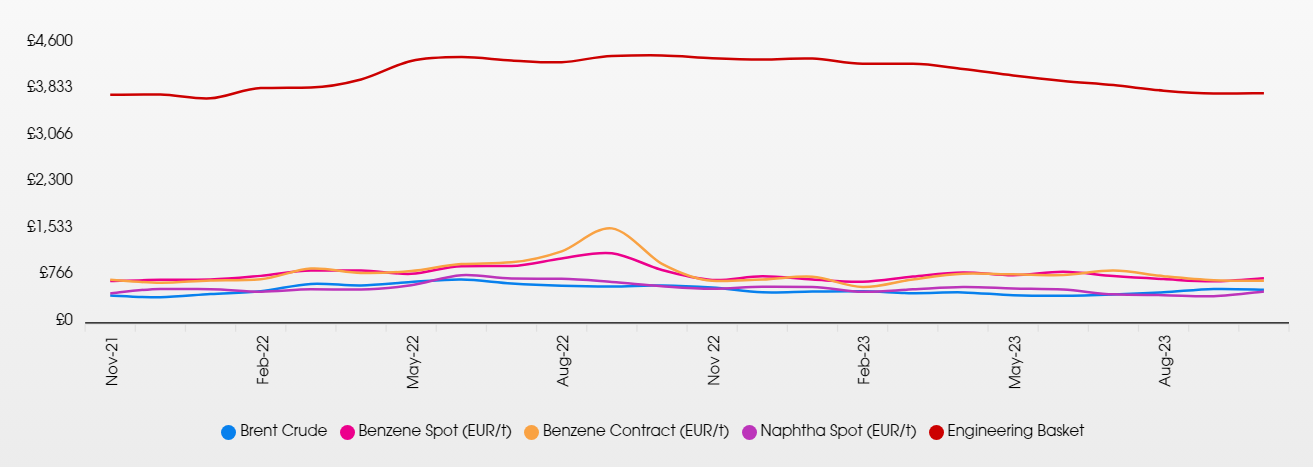

Engineering Polymers

With the Christmas season nearly upon us and a shorter trading month, there is no change in expectations in terms of low customer demand or pricing. Inventories are plentiful and competition fierce, as we continue to see cheaper imports from Asia. There is little appetite to purchase any significant volumes before the end of the year.

The benzene contract decreased once again in December by €133/mt.

Sharron Jarvis

Product Supervisor – Engineering Polymers

Engineering Polymer Feedstocks

£/Metric Tonne by month

PA6

Supply

Demand

Weak demand halted any chance of producers recouping any additional feedstock costs and they had to settle for rollover pricing.

PA66

Supply

Demand

Cheaper imports and very weak demand continues to put downward pressure on prices.

POM

Supply

Demand

Weak demand and cheaper imports from Asia means no real change to the market anytime soon.

PC

Supply

Demand

The benzene contract has decreased this month by €133 euros per metric tonne compared to last month. Cheaper imports are still arriving, but demand remains low, so there is a strong possibility of producers looking to do end of year deals.

PMMA

Supply

Demand

Demand remains weak in automotive putting further pressure on prices. Reductions are expected as we move into the new year in the hope that this will stimulate some activity.

PBT

Supply

Demand

The outlook remains the same as other polymers, cutbacks to mirror weak demand, putting downward pressure on prices.

Other Engineering Polymers

The situation for other engineering polymers is similar. Most materials are still reducing in price, the market remains weak and there is greater availability from cheaper Asian imports.

Sustainable Polymers

Most recycled materials have stayed relatively stable with some slight drops to match those seen in Prime materials. Supply continues to be good and whilst some have seen stronger demand in the run up to Christmas, most markets are still quite flat.

Ian Chisnall

Product Manager – Sustainability

Recycled LDPE / LLDPE

Supply

Demand

Recycled LDPE / LLDPE has stayed fairly level with demand seen as OK and imports more limited than in recent months. Demand in recycled flexible packaging has been boosted in recent months helping to keep prices up.

Recycled HDPE

Supply

Demand

Recycled HDPE is quite steady in pricing with supply and demand seemingly well balanced and producers unwilling to go any lower due to cost pressures.

Demand on high quality grades remains strong with brand owners pushing for recycled content in consumer packaging. Demand in lower quality grades is not as strong with a weak construction sector hitting demand.

Recycled PP

Supply

Demand

Recycled PP is mixed depending on the quality and the application. With expected changes to legislation for recycled content in vehicles, suppliers to the automotive industry are anticipating stronger demand in 2024 and adjusting pricing accordingly.

Lower quality / wider specification grades are still plentiful and whilst producers are reluctant to go further into the red as they are already struggling, market forces may push them into deals to move stock.