Keep an eye out for our Annual Review & Outlook.

Landing in your inbox soon!

We will be publishing an additional special report this month that

takes a look at the previous year and what we can expect from polymer pricing in 2025.

Overview

What will increasing feedstock costs and a stronger USD mean for polymer prices?

Activity in the UK polymer market came to an early close in December, with most transactional activity coming to a halt by the middle of the month. With plentiful supply across the full range of polymers, there was no real appetite for pre-buying and subsequently January has got off to a typically slow start, with the expectation that plastic converters will meet their needs on a day-to-day basis.

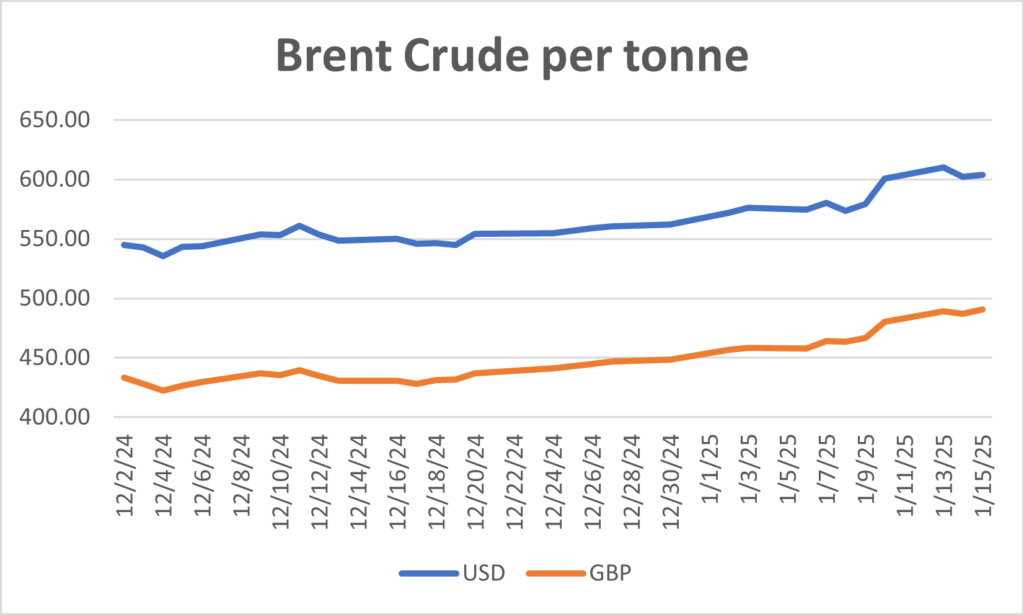

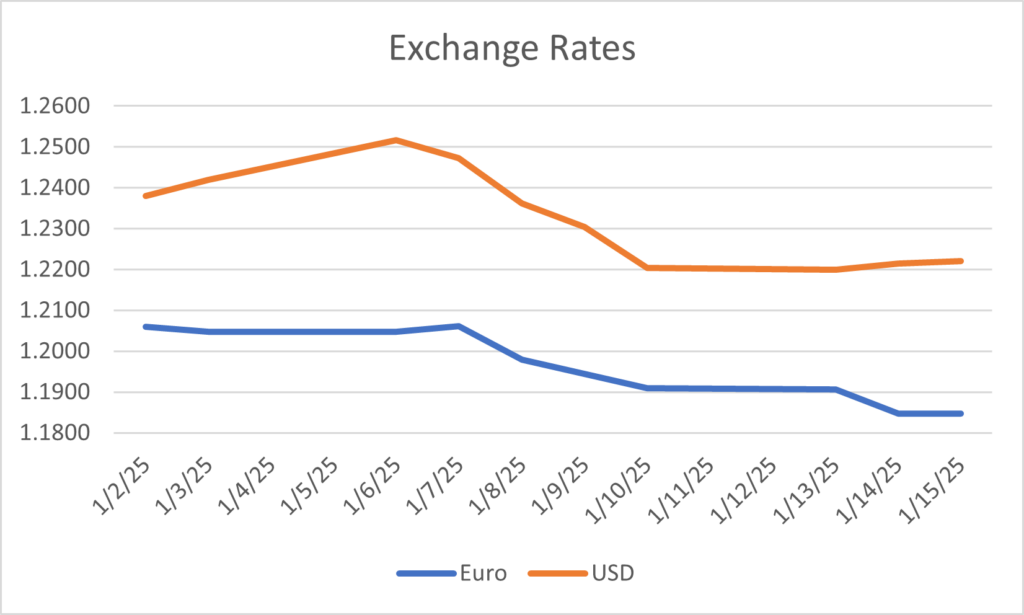

In the background inflationary pressures continue to mount with both a gradual uptick in global crude oil prices and a fall in the value of the GBP against other major currencies which results from concerns about the state of the UK economy.

If the increase in crude oil price is maintained throughout January, then it is likely that C2 and C3 contract prices will increase for February, which will result in price increase nominations for PE and PP. The increase in SM pricing has already resulted in price increases for January shipments of styrenic polymers from European producers.

Monomer Price Movement

Feedstock

Price per Tonne

Change (contract)

C2 (Ethylene)

£998.47

£0.00

C3 (Propylene)

£890.75

£0.00

SM (Styrene Monomer)

£1,196.51

£29.83

Benzene

£710.11

£37.29

Butadiene

£816.18

£0.00

Brent Crude (monthly average)

£435.43

-£1.80

Exchange Rates

€

1.21

$

1.26

€/$

1.05

Mike Boswell

Managing Director – Plastribution Group

Oil Prices

No Data Found

Exchange Rates

No Data Found

UK Economic Data

Topic

Item

Date

Change

Trend

GDP

Real GDP (Q on Q)

Q3 2024

£639,452

PMI

UK Manufacturing PMI

December

47.0%

UK Output

Manufacturing Index

Q3 2024

100.4%

Sales

New Car Registrations (Y on Y)

December YTD

1,952,778

Sales

Retail Sales (Y on Y)

November 24

104.9%

Labour

Unemployment Rate

Aug 24 – Oct 24

4.3%

Prices

CPI (Y on Y)

December

2.5%

Prices

RPI (Y on Y)

November

3.6%

Interest Rates

Bank of England Base Rate

November

4.75%

Polyolefins

We start the New Year with what appears to be a rollover or close to it. Ethylene C2 and Propylene C3 both rolled over and the polymers appear to be following suit. With PE, there have been some attempts to increase prices, as local producers look to restore margins that were significantly eroded in the second half of last year. This has seen a mixed response, with LDPE perhaps able to gain little ground as there are some interruptions in supply.

Deep Sea imports are also facing cost pressures as the US$ has strengthened against the £. The deals possible at the end of 2024 have dried up. PP is more likely to see rollover as demand continues to be weak in key sectors and supply, whilst slightly reduced from lower imports, is ample.

Outlook for the first quarter is that we will likely see more attempts at price increases. Imports are more expensive, and US producers are looking to raise prices for exports. We are also expecting some planned shutdowns in Europe, limiting availability. We face some uncertainty with the prospect of tariffs imposed by USA leading to increased tariffs on US exports of polymers, mainly LLDPE and HDPE. Freight is expected to be a little bit bumpy in pricing this year but the possibility of port worker strike action in the USA limiting exports has been successfully resolved.

Ian Chisnall

Product Manager – Polyolefins

Polyolefins Feedstocks

£/Metric Tonne by month

No Data Found

LDPE

Supply

Demand

LDPE is slightly tighter than in recent months and may see increases, LDPE is dependent on local supply from within Europe and we have seen some unplanned shutdowns limiting availability.

LLDPE

Supply

Demand

C4 LLDPE is a rollover in most cases, but the very lowest offers have disappeared as the discount offers from USA in 2024 have gone and the US$ has strengthened.

Demand in early 2025 appears to be slightly better than the end of 2024 and some restocking is apparent. C6 and Metallocene markets appears to have good availability also leading to rollover.

HDPE

Supply

Demand

HDPE is rolling over but like LLDPE, the very low offers, particularly on Blow Moulding grades have dried up with the special deals from USA all gone. Market demand is slightly better, and we may see pushes for increases in the coming months.

PP

Supply

Demand

PP pricing has rolled over into January. Whilst demand is still muted, supply faces a few restrictions with some European plants unexpectedly shutting in December and imports restricted by higher freight rates. European industry faces some tough questions this year and announcements on plant closures and rationalisation are expected this quarter.

Other Polyolefins

EVA pricing has rolled over. Polyolefin Elastomers are also rolling over in line with monomer.

Styrenics

Contract EU Styrene rises

Styrene Monomer has increased by €36/T, settling at €1444/T.

For December, EU GPPS and HIPS increased by €50/T and ABS rolled.

GPPS/HIPS/ABS supply chains are running at reduced rates, no doubt triggered by low demand. Converters and distributors are running inventory at very low levels due to financial pressures. Therefore, any adjustments in polymer prices are likely to be passed on immediately.

Andrew Waterfield

Product Supervisor – Styrenics

Styrenics Feedstocks

£/Metric Tonne by month

No Data Found

PS

Supply

Demand

December SM fell slightly (-€7/T), with Monomer settling at €1408/T. Supply was normal, albeit at reduced levels, but demand poor, as most converters had already stocked up due to holidays

January does little to change the situation. Prices have risen by €50/T on average. Despite SM availability contracting as a Netherlands plant closes due to financial pressure, availability is good, highlighting the very poor demand for this product currently.

ABS

Supply

Demand

December prices rolled over (SM +€7/t, butadiene -€50/t, ACN +€9/t). Availability was fine, but demand low due to the same reasons as PS.

January shows a slight uplift in pricing, and far eastern materials are affected by Sterling weakening. (SM +€36/t, butadiene roll, ACN +€9/t)

Supply is good as all EU plants are up and running, with some producing over the holidays, but demand is now very subdued, with the expectation of some improvement mid month.

PC/ABS

Supply

Demand

As usual, PC/ABS price is following the trend of ABS, but supply/demand are not as extreme.

Other Styrenics

SAN and specialities such as ASA and Q Resin continue to follow the price trend of ABS.

Engineering Polymers

The start to the new year has been slow, demand remains extremely poor across most materials and market sectors. Inventories are heavily stocked, and prices continue to fall for most polymers apart from PMMA.

The January benzene contract settled €45/Mt higher than December at €857/Mt.

Sharron Jarvis

Product Supervisor – Engineering Polymers

Engineering Polymer Feedstocks

£/Metric Tonne by month

No Data Found

PA6

Supply

Demand

Poor demand, high inventory levels and further reductions in price.

PA66

Supply

Demand

Weak demand, reducing prices and no recovery expected, partly due to the dire automotive sector.

POM

Supply

Demand

As we approach the Chinese New Year, imports are likely to reduce as shipping costs are expected to increase and container space becomes limited.

PC

Supply

Demand

PMMA

Supply

Demand

Some producers have taken the decision to increase prices into quarter one, demand remains poor especially in the automotive sector so it remains to be seen if this can be achieved.

PBT

Supply

Demand

Weak demand and rollover prices.

Other Engineering Polymers

The current situation for most other engineering materials is similar, with weak demand and downward price pressure.

Sustainable Polymers

Recycled Polyolefins have mostly rolled over in January alongside prime prices. Some recent plant closures in the UK and in Europe are helping to bolster pricing at the lower levels as supply is slightly restricted. Buyers are facing the realisation that they can’t keep buying at a lower than cost level and expect their suppliers to remain in business. New legislation is expected to keep prices stronger in 2025.

Ian Chisnall

Product Manager – Sustainability

Recycled LDPE / LLDPE

Supply

Demand

Recycled LDPE / LLDPE has mostly rolled over in January. High-quality grades continue to see strong demand and restricted availability leading to prices above virgin.

Lower quality grades are seeing better pricing than in recent months as supply is slightly limited after extended Christmas shutdowns.

Recycled HDPE

Supply

Demand

Recycled HDPE is typically rollover and is seeing some slight increases at the lower end with supply slightly restricted.

Natural grades for consumer packaging continue to see significant premiums over virgin prices.

Recycled PP

Supply

Demand

Recycled PP is rolling over in January and as with recycled PE, the very lowest prices offered last year are gone as recyclers need to return to making a margin.

Natural grades continue to command strong premiums over virgin, particularly in consumer packaging applications.