Overview

Falling crude oil prices and soft demand put downward pressure on polymer prices.

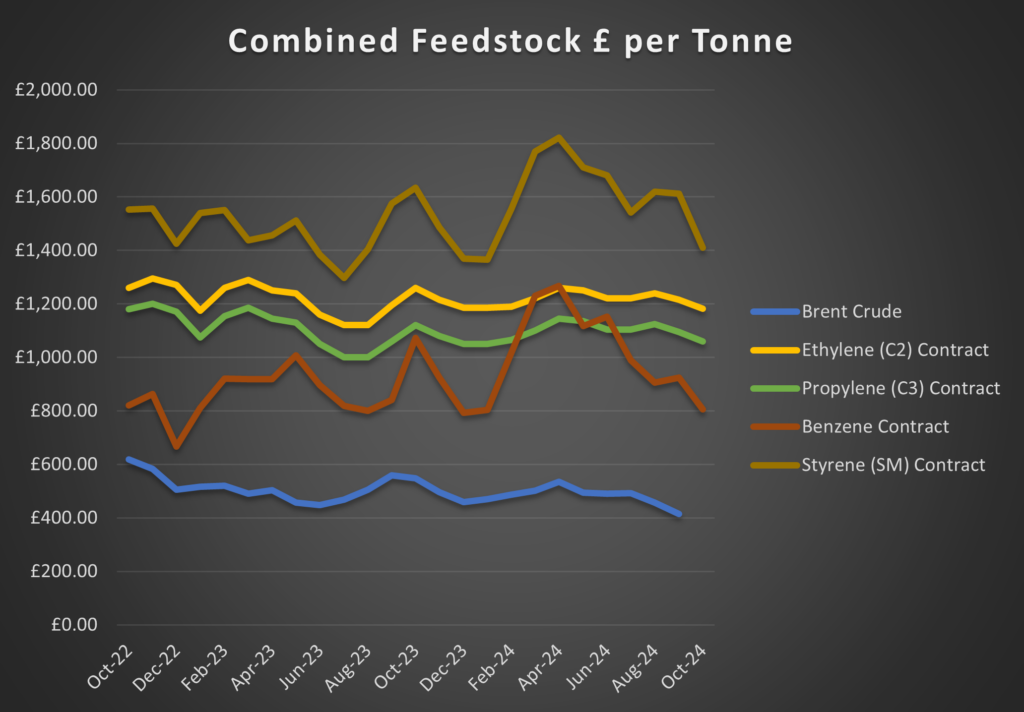

Despite geopolitical tensions in the Middle East, crude oil prices remain under pressure as concerns about economic growth in China persist. The squeeze from lower crude oil pricing was directly reflected in C2 (ethylene) and C3 (propylene) monomers. The exaggerated fall in Benzene and SM (Styrene Monomer) was more surprising.

In the case of PE (polyethylene) the concerns about supply shortages from the US, resulting from dockworkers taking strike action along The Eastern Seaboard and The Gulf of Mexico have been very short-lived, albeit with a possibility that further industrial action my take place in January 2025 if a long-term agreement between employers and unions cannot be brokered.

In reality, any delays in shipping will be adequately covered by material already in the supply chain.

Given the backdrop of weak demand for polymers and finished products, it looks as if the monomer discounts will be applied to polymers, with the possibility of greater reductions if sellers have an appetite to chase available volumes.

Monomer Price Movement

Feedstock

Price per Tonne

Change (contract)

C2 (Ethylene)

£1,034.91

-£6.60

C3 (Propylene)

£932.70

-£29.81

SM (Styrene Monomer)

£1,373.07

-£165.25

Benzene

£787.04

-£116.69

Brent Crude (monthly average)

£457.29

-£35.09

Exchange Rates

€

1.17

$

1.29

€/$

1.10

Mike Boswell

Managing Director – Plastribution Group

Oil Prices

No Data Found

Exchange Rates

No Data Found

UK Economic Data

Topic

Item

Date

Change

Trend

GDP

Real GDP (Q on Q)

Q2 2024

£639095

PMI

UK Manufacturing PMI

August

50.5%

UK Output

Manufacturing Index

Q2 2024

101.6%

Sales

New Car Registrations (Y on Y)

September YTD

1,514,094

Sales

Retail Sales (Y on Y)

August 24

106.2%

Labour

Unemployment Rate

May 24 – Jul 24

4.1%

Prices

CPI (Y on Y)

August

2.2%

Prices

RPI (Y on Y)

August

3.5%

Interest Rates

Bank of England Base Rate

August

5.0%

Polyolefins

Polyolefin prices are mostly falling in October following further reductions in Ethylene C2 and Propylene C3.

Some European producers have held out for rollover citing very poor economics of production. There were some initial concerns over port strikes in the USA and escalating tensions in the Middle East leading to shortages, but most market players seem unconcerned.

Demand continues to be relatively poor, with a general economic malaise. Supply continues to be plentiful with new capacities added this year for both PE and PP. Broadly speaking, the market has moved down by the monomer (around £30 / MT), but there are more spot deals available than in recent months. There are some bigger reductions from suppliers that tried stronger pricing in September as they look to move prices more in line with the market.

The outlook for the rest of 2024 suggests that prices will remain relatively flat to slightly down, but we face a final quarter with some uncertainty. US elections & Middle Eastern political tensions will have an influence before the end of the year.

I predict that early in 2025, we should see a price rebound. Of course, a lot could happen between now and then.

Ian Chisnall

Product Manager – Polyolefins

Polyolefins Feedstocks

£/Metric Tonne by month

No Data Found

LDPE

Supply

Demand

LDPE is mostly following the monomer downward (around £30 / MT), but some producers have held out for rollover.

One polymer producer has commented: “the economics of converting Ethylene to Polyethylene currently don’t make sense, we make more money selling the Ethylene…”

Having seen supply shortages in recent months, we’re now starting to see better availability and prices are falling as a result.

LLDPE

Supply

Demand

C4 LLDPE has moved down by around monomer for immediate availability.

There are more spot deals available for delivery later in the year as logistics costs continue to come down and availability becomes better.

There were some suggestions that the port strike in USA would affect LLDPE supplies in the medium term but that appears to be resolved for the time being.

HDPE

Supply

Demand

HDPE is a similar story to LLDPE and is dropping by monomer with the odd bigger increase seen depending on starting point and the circumstances of that supplier.

Availability continues to improve and with demand still relatively poor, prices are likely to soften a little more in the coming months.

PP

Supply

Demand

PP pricing has mostly dropped by monomer (£30 / MT) in October with some suppliers either side of that depending on their availability and desire to move stocks.

European production of PP continues to see challenges with some planned and unplanned shutdowns, but imports are returning to keep the market well supplied.

Other Polyolefins

EVA pricing has dropped in line with most PE grades. Polyolefin Elastomers are also typically falling with monomer pricing as we enter a new quarter.

Styrenics

Contract EU Styrene price collapses, EU polymer prices follow.

Styrene Monomer has fallen by €202T, settling at €1410/T.

For October, EU GPPS and HIPS fell sharply, and ABS reduced. EU materials have closed the gap with imports as deep sea materials have remained level.

GPPS/HIPS/ABS supply chains are still running very low. Polymer producers have been running output at a minimum due to poor demand, and converters and distributors running inventory at very low levels due to financial pressures. Therefore, any adjustments in polymer prices are likely to be passed on immediately.

Andrew Waterfield

Product Supervisor – Styrenics

Styrenics Feedstocks

£/Metric Tonne by month

No Data Found

PS

Supply

Demand

September delivered a SM rollover in real terms (-€8/T), despite early predictions pointing to a significant drop.

PS producers announced a rollover too. Supply was normal and demand improved slightly as we moved out of the holiday period. Expectations of a fall in the near future caused converters to hold back on large orders.

October SM has fallen steeply, with Monomer settling at €1410/T, a €202/T reduction on September. Supply remains normal, and a reduction this large could cause converters to begin restocking. With supply chains low on stock, a significant increase in demand could possibly cause a shortage.

ABS

Supply

Demand

September showed a rollover in real terms (SM -€8/t, butadiene roll, ACN -€7/t). Supply was acceptable, and demand steadily increased after the August break.

October prices fell (SM -€202/t, butadiene roll, ACN -€28/t). Supply volumes will be sufficient, and the drop could spur a demand increase as converters being to restock. A demand spike could put increased pressure on an already tight supply chain.

PC/ABS

Supply

Demand

As usual, PC/ABS price is following the trend of ABS.

Other Styrenics

SAN and specialities such as ASA and Q Resin continue to follow the price trend of ABS.

Engineering Polymers

October has started quiet. We are seeing further cutbacks in production and reducing prices for most engineering materials.

The October benzene contract settled €119/Mt lower than September at €805/Mt.

Sharron Jarvis

Product Supervisor – Engineering Polymers

Engineering Polymer Feedstocks

£/Metric Tonne by month

No Data Found

PA6

Supply

Demand

Low demand, high inventory levels and reducing prices.

PA66

Supply

Demand

A similar picture to PA6. Poor demand so there are likely to be some further cost reductions.

POM

Supply

Demand

Producers are trying to hold on to rollover prices, this could prove difficult with such low demand.

PC

Supply

Demand

PMMA

Supply

Demand

With ongoing restricted supply of MMA some producers have implemented increases, it remains to be seen if they can achieve this given the poor demand.

PBT

Supply

Demand

Minor change expected for October, weak demand and reducing prices.

Other Engineering Polymers

The current situation for most other engineering materials is similar, weak demand and downward price pressure.

Sustainable Polymers

Recycled Polyolefins have mostly rolled over in October as producers have very little room to offer reductions from current levels. Whilst virgin prices have dropped, recyclers have not seen this pass through into their feedstocks and are unable to offer any kind of reduction based on their current cost position.

Demand seems to be OK with more interest in avoiding packaging taxes and offering a sustainable solution to end users.

Ian Chisnall

Product Manager – Sustainability

Recycled LDPE / LLDPE

Supply

Demand

Recycled LDPE / LLDPE has mostly rolled over in October.

High-quality grades continue to see strong demand and restricted availability leading to prices keeping above virgin.

Recycled HDPE

Supply

Demand

Recycled HDPE is typically rollover with industrial grades continuing to be under pressure.

Natural grades for consumer packaging continue to see very strong demand in both injection and blow moulding.

Significant premiums over virgin prices are continuing and industrial grades are under increased pressure as seasonal demand in sectors such as construction is low.

Recycled PP

Supply

Demand

Recycled PP is trying for rollover in October, but prices are under pressure with availability still good and demand slightly weak, especially for the industrial quality grades.

As with other recycled grades, high quality natural commands a strong premium over virgin.