Overview

The September increase in contract monomer pricing was widely anticipated and is largely a result of firming crude oil prices and the consequent impact on energy cost. SM (Styrene Monomer) pricing was further enhanced by significant production restrictions resulting from a combination of planned and unplanned outages. The stimulus of input cost inflation has caused polymer producers to push for increases in excess of the hikes for the respective monomers.

Given that price increases were anticipated, many polymer converters increased inventories leading to a situation where converters are favouring the use of these inventories in order to resist accepting the price hikes. Furthermore, downstream demand remains subdued. In these circumstances it is likely that the supply demand balance will be the ultimate arbiter of price, and this is likely to come down to a material type and even grade level; by way of example supply of LDPE MFR 0.3 currently is extremely tight resulting in greater opportunity for suppliers to push through increases.

Whilst the scale and timing of increases may lack certainty, it appears that for most volume polymers the market is at, or about the very bottom with future price movements expected to be level or upwards.

Any recovery in downstream demand, could push market fundamentals towards shortage with clear implications for prices.

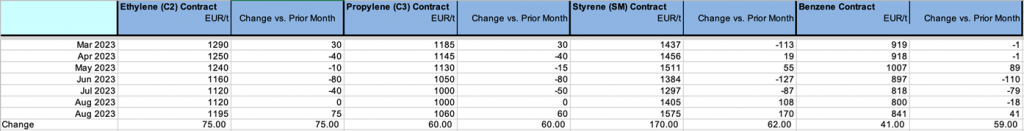

Click the table above to zoom in.

The situation for more specialised materials continues to be rather weak, with sellers chasing available business and competing for market share. Some recovery in demand for mobility/automotive applications has not been matched with increased demand in the consumable durables and construction sectors and hence the on-going weak demand overall.

Monomer Price Movement

Feedstock

Change (Contract)

C2 (Ethylene)

£64.40

C3 (Propylene)

£51.52

SM (Styrene Monomer)

£145.98

Benzene

£35.21

Brent Crude (monthly average)

£36.33

Exchange Rate

1.16

Mike Boswell

Managing Director – Plastribution Group

Oil Prices

No Data Found

Exchange Rates

No Data Found

UK Economic Data

Topic

Item

Date

Change

Trend

GDP

Real GDP (Q on Q)

Q1 2023

£558,812

UK Output

Manufacturing Index

Q2 2023

107.2%

Sales

New Car Registrations (Y on Y)

August 23

85,657

Sales

Retail Sales (Y on Y)

July 23

116.3%

Labour

Unemployment Rate

May – July 2023

4.3%

Prices

CPI (Y on Y)

July

6.8%

Prices

RPI (Y on Y)

July

9.0%

Interest Rates

Bank of England Base Rate

August

5.25%

Polyolefins

After hitting the bottom of the market in August, the predicted price rises in September have come to pass but are varying quite significantly across the range of Polyolefin products. All PE grades have at least achieved the C2 monomer increase of €75 / MT with some grades moving beyond that due to restricted availability. However, whilst some producers of PP have sought increases beyond the C3 monomer increase of €60 / MT, most are going with monomer and those with excess product are agreeing to increases of €30-40 / MT to try and move stock.

With PE, we’re seeing the effects of reduced output in the Middle East following several turnarounds and stoppages. USA producers looking for increased prices locally and this is limiting buying interest from Europe accordingly. Demand in PE has improved slightly with seasonal factors improving consumption in some sectors. Supply is now much more balanced with stronger buying interest helping the price increases to be passed through without much opposition. Some grades, such as LDPE are reported as tight.

PP is not in as strong a position and demand continues to be poor with supply relatively ample. One producer has taken the decision to close an old PP line in Europe. Whilst this is a relatively expensive undertaking, Europe, has on average, the oldest plants in the world (nearly 30 years old) and with the high running costs associated with keeping them going, some are now unsustainable. The effects of this could be felt in 2024.

Outlook beyond September is unclear, there is already talk of further increases in monomers based on rising oil prices and Naphtha. However, Global demand continues to poor, and all eyes will be on China and their usage. If we see an uptick in demand, then further increases are likely but without that, a rollover in October becomes more likely.

Ian Chisnall

Product Manager – Polyolefins

Polyolefins Feedstocks

£/Metric Tonne by month

No Data Found

LDPE

Supply

Demand

LDPE has seen the strongest gains this month with €100 / MT seen as the minimum increase anybody will settle for over August pricing.

Many are looking for +€120-150 / MT and there are rumours of order stops being put in place with limited availability in Europe. Fractional melt (0.3) grades are seen as particularly tight and are commanding premiums over other grades.

LLDPE

Supply

Demand

C4 LLDPE has mostly seen increases of €75 / MT, but some are looking for €150 / MT due to poor availability of imports and are looking to manage demand for limited stocks through aggressive pricing.

With limited supply from the Middle East and increased prices from USA putting off European buyers, we are in a tightening market. Some are not expecting new material until very late in October and are restricting supply. C6 grades have lost some premium over C4 as they are more readily available.

Metallocene grades, having recovered some premium in August, are now edging towards long as imports remain strong from new market entrants.

HDPE

Supply

Demand

HDPE has broadly moved with the monomer increase of €75 / MT. Blow moulding grades are perhaps a little tight in supply and are seeing increases a bit beyond that. As with LLDPE, sellers dependent on fresh imports are seeking three digit increases as they manage limited stocks.

PP

Supply

Demand

PP continues to face more challenges than PE as demand is not picking up as strongly as hoped.

With supply still strong, no increases beyond the monomer settlement of €60 / MT are being accepted by the market. Whilst +€60 / MT does appear to have broad acceptance; some are pushing for discounts as buyers have far better cards to play than sellers now.

There are some outliers who are looking for three figure increases having done deals to sell out stock in August but there is an expectation of a retreat from these positions.

Other Polyolefins

EVA pricing has gone with the monomer increase as although demand is weak, availability is somewhat limited in Europe with Total continuing to face issues in producing on-spec EVA. Polyolefin Elastomers prices have either increased with monomer or have rolled over for those who agree quarterly pricing.

Styrenics

Spot Styrene Monomer continues to rise, and Contract SM follows.

EU Contract SM price had been in a slow decline since Q3 2022, driven by poor demand, and oversupply. Due to this poor demand, in mid-July a large EU SM plant was mothballed, initially for July and August, but with the possibility to extend further, driving August SM price up by €108/T. It has now been announced that this plant will close, permanently removing 9% of total EU SM Production, and with some EU plants on maintenance shutdown, another €170/T has been added to September prices.

The outcome of this is that EU SM production is currently very low, and while US imports are now available again, nothing is likely to arrive for many weeks.

For September, EU GPPS and HIPS has increased by €170/T, and EU ABS by €135-150/T on average.

To compound the problem, GPPS/HIPS/ABS supply chains are empty. Polymer producers have been running output at a minimum due to poor demand, and converters and distributors running inventory at very low levels due to financial pressures. Therefore, the shift in SM/PS prices is likely to have an instant effect.

It is to be noted that the shift in EU styrene monomer is unlikely to have a large effect on Styrenic materials imported from the Far East.

Andrew Waterfield

Product Supervisor – Styrenics

Styrenics Feedstocks

£/Metric Tonne by month

No Data Found

PS

Supply

Demand

August contract SM rose by €108/T, with PS increasing by similar amounts. Monomer shortages impacted PS supply, where producers have been running at minimum output, but demand was expected to be low due to the summer holiday season.

SM supply limitations have had a huge impact on September pricing, with GPPS and HIPS rising by €170-180/T. Availability is ok, but demand will increase after the holiday period, and shortages could occur.

ABS

Supply

Demand

August ABS was steady (SM +€108/t, butadiene -€ 150/t, ACN -€16/t). Oversupply still loomed, and demand was held back by a weak economy and high interest rates, restricting any appetite for inventory building.

September ABS prices have soared, driven by monomer hikes (SM +€170/t, butadiene +€ 35/t, ACN +€86/t), with rises of €170-180/T announced for EU material. However, it is likely deep-sea material will be more stable, due to lead times involved.

PC/ABS

Supply

Demand

As usual, PC/ABS price is following the trend of ABS.

Other Styrenics

SAN and specialities such as ASA and SMMA continue to follow the price trend of ABS.

Engineering Polymers

The market remains weak, and inventory levels are more than adequate to fulfil open order books. We continue to see cheaper imports arriving from Asia which means there is likely to be further price erosion on most engineering materials. Given the dynamics it is questionable that we will see any significant upswing in demand in September as previously hoped for.

The benzene contract was fixed €41/mt higher than August so this could slow down or even halt the downward price trend for polycarbonate, but due to poor demand it is unlikely we will see any significant change anytime soon.

Sharron Jarvis

Product Supervisor – Engineering Polymers

Engineering Polymer Feedstocks

£/Metric Tonne by month

No Data Found

PA6

Supply

Demand

High level of imports and weak demand means prices continue to fall.

PA66

Supply

Demand

A similar picture to PA6, extremely poor demand, cheaper imports, and downward pressure on prices.

POM

Supply

Demand

Cutbacks in production in Europe continues to reflect poor demand. Cheaper imports from Asia continue to put downward pressure on pricing.

PC

Supply

Demand

PMMA

Supply

Demand

Demand remains weak, downward pressure on prices with no immediate recovery expected anytime soon.

PBT

Supply

Demand

The same situation as for many engineering polymers, weak demand, downward pressure on prices.

Other Engineering Polymers

The situation for other engineering polymers is broadly similar. All materials are reducing in price, the market remains weak and there is greater availability from cheaper Asian imports.